Cross-Border Clarity – December 2025 Edition

December is the month where cross-border finance goes from “I’ll handle that soon” to “I should’ve handled that last week”. With currency volatility, year-end filings, and new rules kicking in, now’s the time to tidy up.

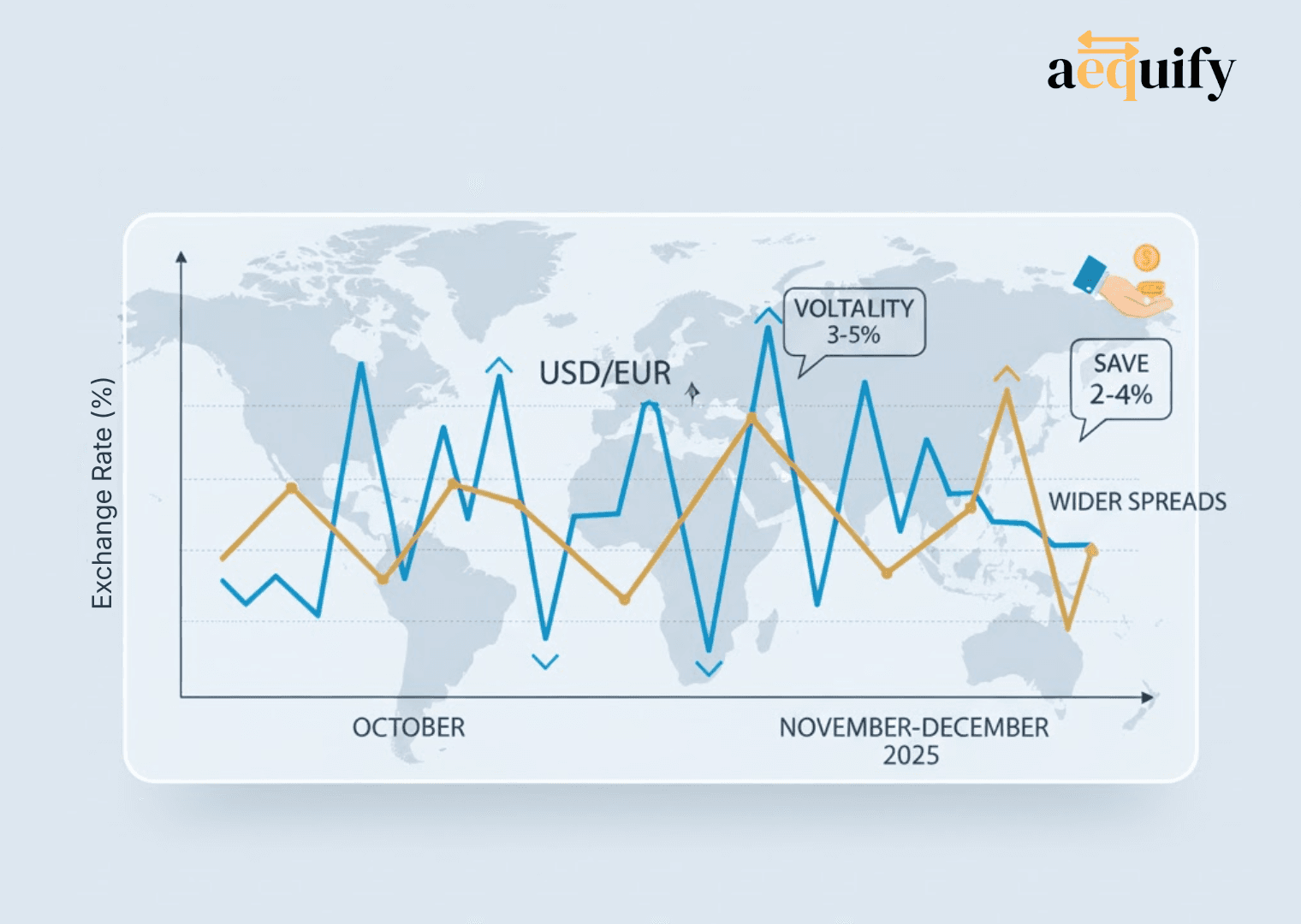

FX: the quiet cost of December

Currency spreads typically widen into November and December as transfer volumes spike. This year, volatility in USD, GBP, and EUR corridors has reached 3–5% over the past two months.

💡To improve outcomes:

Compare at least two transfer routes (bank wire, fintech, ACH→local).

Execute weekday mornings in both corridors for tighter spreads.

Consolidate multiple small transfers into fewer, larger ones.

Check inbound wire fees – several banks quietly raised them in Q3.

Even minor timing adjustments can reduce costs by 2–4% on average.

FBAR Late? Not the end of the world!

If October 15 came and went:

You can still file late

Include a brief reasonable cause explanation

Regulators prefer “sorry, here it is” over silence

Waiting longer = unnecessary risk

Resources: Delinquent FBAR submission - IRS

Aequify now pulls your highest balances automatically, applies annual FX, and gives you export-ready data. No spreadsheets. No guessing.

Policy moves worth noting

🇺🇸 Higher U.S. Foreign Earned Income Exclusion

For the 2026 tax year, the Foreign Earned Income Exclusion (FEIE) limit will rise to $132,900 from $130,000 per person in 2025.

What this means for you: If you use or may use FEIE, you can keep a bit more of your foreign salary after tax in 2025 and 2026. Check that your employer or advisor use these updated limits in their planning.

🇨🇦 Canada 2025 budget and tax integrity

Canada’s 2025 federal budget did not raise personal tax rates across the board, but it did add targeted “tax integrity” measures.

The government plans to tighten international tax rules, including rules around foreign assets and complex structures, and to end the federal Underused Housing Tax starting in 2025.

What this means for you: If you have ties to Canada and own property, foreign accounts, or investments, expect a closer review of how you report them. Make sure your records, values, and forms are complete and accurate.

Product Highlights – Built to reduce friction

We have been working hard to delight you with new features. In November, we launched two major features and have been receiving amazing feedback from our closed beta users. Try and let us know what you think. .

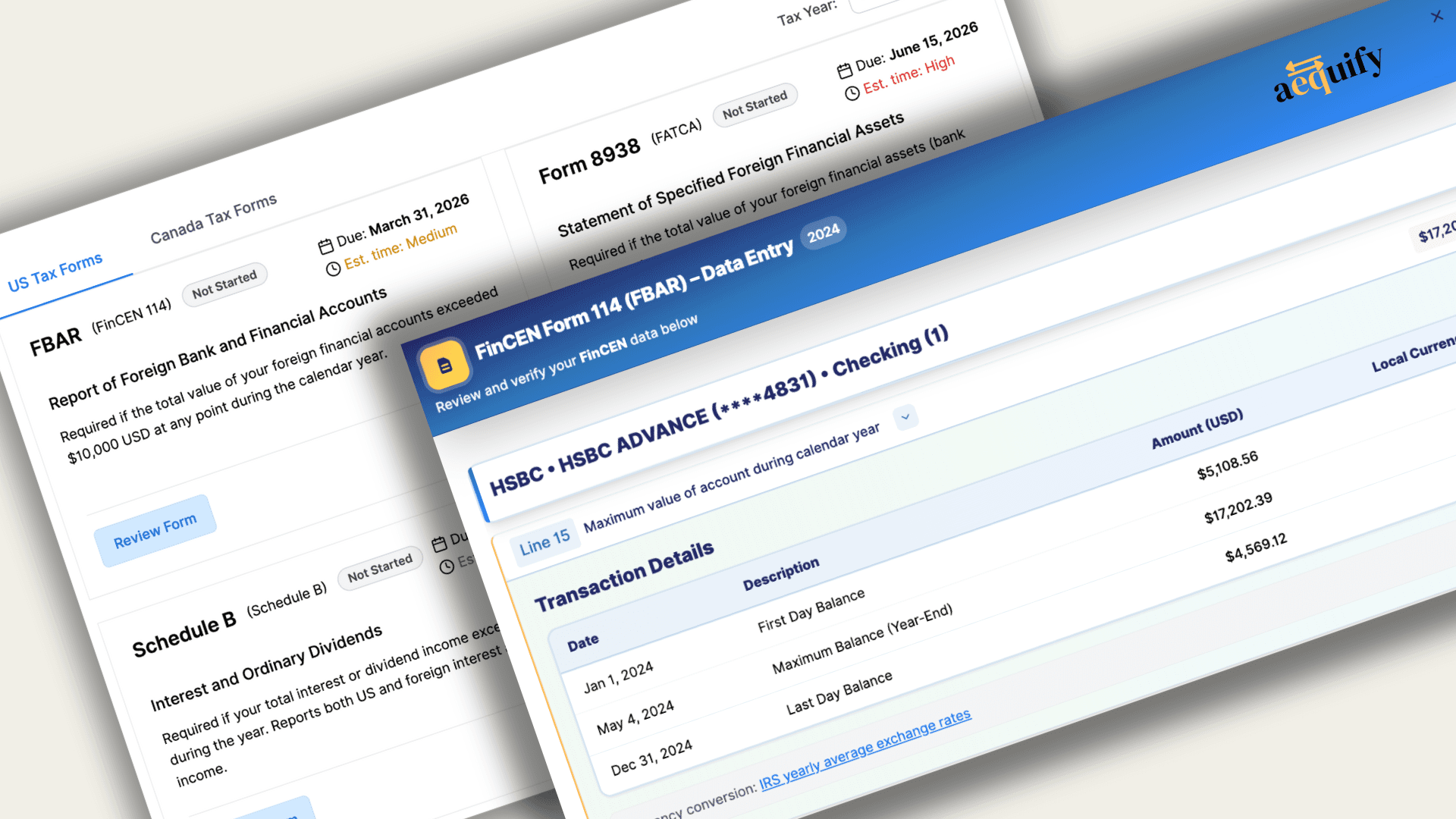

1. Pre processed tax data for U.S. expats

Pulling data from many bank and investment accounts is slow and easy to mess up.

Aequify now does the heavy lifting for key U.S. expat forms.

We connect to your accounts and map transactions into tax ready buckets.

We check which tax forms you need to file to stay compliant.

You get data formatted for FBAR, FATCA, and Schedule B instantly.

You and your advisor can skip most of the manual spreadsheet work.

More forms are in progress so more of your return can flow from one clean data source. If there are any forms you want us to prioritize, please let me know by emailing support@aequify.com.

2. One click sharing with your tax advisor

Sending data to your tax advisor should not mean downloading statements and emailing spreadsheets.

Now you can:

Share your Aequify tax data with your chosen advisor in a single click.

Give them secure, read only access instead of sending files.

Cut back and forth, missing attachments, and version confusion.

Result: fewer emails, fewer mistakes, and less time spent chasing data.

3. Trusted Tax and Financial Consultant Marketplace. Coming in December…

Many expats tell us the same thing.

“It is hard and expensive to find someone who really understands my cross border taxes.”

So in December, we are launching the Aequify advisor marketplace.

All advisors are pre-vetted, certified, and reviewed for cross border experience.

You see pricing and scope up front.

Your payment is held until the work is completed, so your money is protected.

You get a trusted list of experts who understand expat profiles, not a random directory.